Since its founding, ULI Greenprint’s real estate community of practice has always had a collective goal to reduce carbon emissions 50 percent by 2030. Greenprint members have found that reducing carbon and driving energy efficiency in their real estate portfolios makes good business sense, and they are on track to achieve that 50 percent goal.

But with the pace of the market and the increasing threat of the climate crisis, a larger goal was needed. Enter the ULI Greenprint net zero carbon operations by 2050 goal. This new net zero carbon goal is designed to meaningfully reduce the built environment’s impact on climate change beyond existing efforts, and provided an opportunity for real estate leaders to publicly align to an industry standard in a meaningful and pragmatic way (https://uli.org/netzerogoal).

By the end of FY21, 17 Greenprint member companies publicly aligned with the net zero goal representing over $570 billion in assets under management, over 709 million square feet (65 million sq m), and over 3,300 properties across 20 countries: Allianz Real Estate, Boston Properties (by 2025), City Developments Limited, CommonWealth Partners, Heitman (by 2030), Hudson Pacific Properties (by 2025), Jamestown LP, Kilroy Realty Corporation (by 2020), LaSalle Investment Management), Morgan Creek Ventures, MultiGreen, NEO, Nuveen Real Estate, PGIM Real Estate, Rudin Management Company, Savanna, and the Tower Companies.

“Real estate leadership on environmental, social, and governance is critical as the industry moves to decarbonize building operations,” says Marta Schantz, senior vice president of the ULI Greenprint Center for Building Performance. “By addressing the area under operational control with the ULI Greenprint net zero goal, these firms are tackling carbon emissions across their portfolios in a deeply meaningful and measurable way.”

For the real estate sector, net zero brings challenges when owners have only so much control over their properties’ energy use and carbon emissions. ULI defines net zero in line with the World Green Building Council, as a building portfolio that is highly efficiency and powered by on- or off-site renewables, including offsets. The goal is also in line with the Paris Agreement, and findings from the Intergovernmental Panel on Climate Change report to limit global warming to 1.5 degrees Celsius. The baseline net zero goal is based on the CDP scope 1 and 2 greenhouse gas emissions, and direct operational control, excluding occupant operations. Members can choose to go beyond scope 1 and 2 to include occupant operations and embodied carbon, as well as setting a faster timeline, if they so choose.

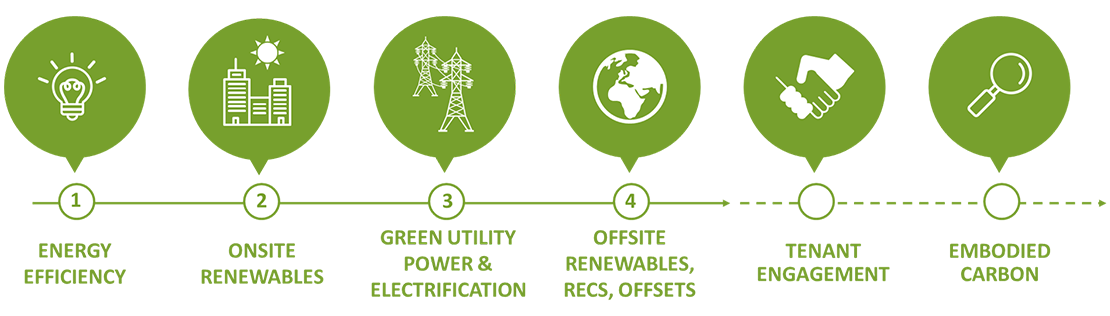

Over time, Greenprint will help members navigate key steps on their journey to net zero by providing guidance, tools, and training to help members make progress toward these goals. The road map starts with energy efficiency as the most cost-effective solution for carbon reductions, moving on to on-site renewables, green power through the utility grid coupled with building electrification, and balancing the remaining emissions with off-site renewables, renewable energy credits, and offsets. Further strategies can include engaging tenants to reduce their emissions and exploring embodied carbon reductions in building materials.

Firms interested in aligning with the ULI Greenprint Net Zero Carbon Operations by 2050 must be Greenprint real estate members to be eligible, and then can reach out to [email protected] to make the commitment.

“At LaSalle we’re committed to doing right by our investors, our people and our planet. When we invest in environmental, social, and governance best practices, we are enhancing the performance of our clients’ investments. That is why we are excited to work with the ULI Greenprint team on net zero carbon ambitions and commit to this industry goal.”—Jeff Jacobson, Global CEO, LaSalle Investment Management

“The severity of our current climate crisis requires a commensurate response and commitment from real estate owners, developers, and managers: NET ZERO. This is a difficult and ambitious commitment for NEO, as we are a real estate company based in an emerging market. However, we firmly believe that we can and must play our part in this global collective effort. We encourage all other real estate firms to heed the call and join us in this fight.”—Raymond Rufino, Chief Executive Officer, NEO Property Management Incorporated

“Nuveen Real Estate is proud to commit to delivering net zero carbon buildings. This is a necessary step for the industry in order to tackle the climate crisis, and it builds on our existing commitment to a 30 percent reduction in energy intensity by 2030 across our portfolio. This will deliver outperformance for our clients as net zero carbon buildings will be protected from obsolescence and will remain relevant in tomorrow’s world. We call on our peers and the wider real estate industry to also step up to this challenge.”—Chris McGibbon, Global Head of Real Estate and Head of the Americas, Nuveen Real Estate

“Climate change is one of the most pressing issues of our time—and inaction is simply no longer an option. Real estate organizations can serve as a catalyst for real change, benefiting the planet and business, and we are pleased to join other leaders to fight the global climate crisis together. Aligning with ULI Greenprint and the Paris Agreement supports our longtime commitment to carbon neutrality and pushes us to go further.”—Jeffrey Abramson, Partner at the Tower Companies.