ULI’s much anticipated semiannual Real Estate Economic Forecasts in the United States have expanded outside the Americas with an inaugural report for the Asia Pacific region being launched in spring 2021. Globally, the markets showed a marked increase in confidence compared with the previous year, and a meeting of the Capital Markets Forum at the ULI Virtual Europe Conference discussed the “10 trends for 2021” to look out for.

In February, high-level ULI members from across the global finance and investment sector gathered via Zoom at the ULI Virtual Europe Conference to discuss capital flows, real estate market dynamics, and debt and equity markets. The invitation-only gathering, limited to 35 attendees, was held under the Chatham House Rule and not for attribution. ULI Europe Chair Marnix Galle and ULI Europe CEO Lisette van Doorn attended, along with other members of ULI Europe’s leadership team.

To kick off the two-hour discussion, an analysis by Avison Young titled “10 Trends for 2021” was presented. Among the trends raised were an acceleration of deglobalization, shifting from “just in time” to “just in case” deliveries, and more interest in the hyperlocal, also characterized as “love thy neighborhood.” The key takeaways were provided for all members in Urban Land online.

U.S. Real Estate Economic Forecast

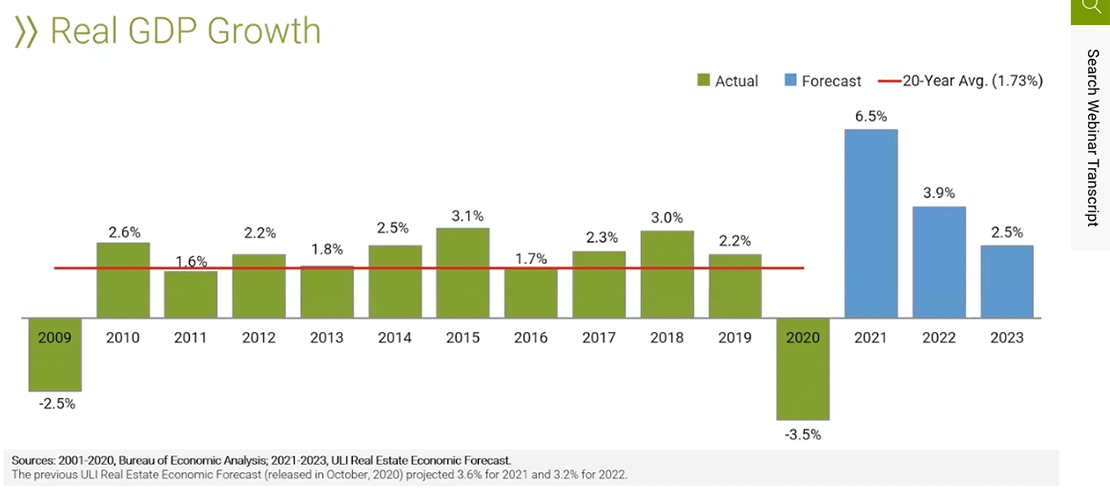

Real estate economists predict markedly improved U.S. economic and property market conditions over the next three years, 2021 to 2023, compared with the forecast of six months ago, according to the spring ULI Real Estate Economic Forecast.

This prediction is not surprising given what has transpired since October 2020—the successful development and rollout of multiple COVID-19 vaccines, a partial reopening of the economy, generally strong gross domestic product and job growth reports, and trillions of dollars of stimulus and relief spending. Forecasters predict that the current recovery—which was kicked off by gross domestic product (GDP) rising by a record 33 percent (annualized) in the third quarter of 2020—will remain robust over the next three years. U.S. real estate market conditions and values are also forecast to perform much better than predicted six months ago, although wide differences by property types are expected to persist.

The Real Estate Economic Forecast, produced by the ULI Center for Real Estate Economics and Capital Markets, is based on a survey conducted in May of 42 economists and analysts at 39 leading real estate organizations. The forecast is based on the median responses gathered in the survey, which reflected a wide range of views, both better and worse.

Although the fall 2020 Forecast was notable in its reversal of many of the pessimistic forecasts from spring 2020, the current forecast goes even further, with several forecasts now ahead of long-term averages. Among the 2021–2023 metrics predicted to outpace long-term averages are GDP and employment growth, the unemployment rate, real estate transaction volumes, warehouse and apartment occupancy and rent growth, and single-family housing starts and price appreciation.

Asia Pacific Real Estate Economic Forecast

The Asia Pacific region’s key real estate markets are likely to witness a sustainable and resilient recovery in the next three years, bouncing back from recent weakness triggered by the spread of COVID-19, according to the inaugural ULI Real Estate Economic Forecast report for the region.

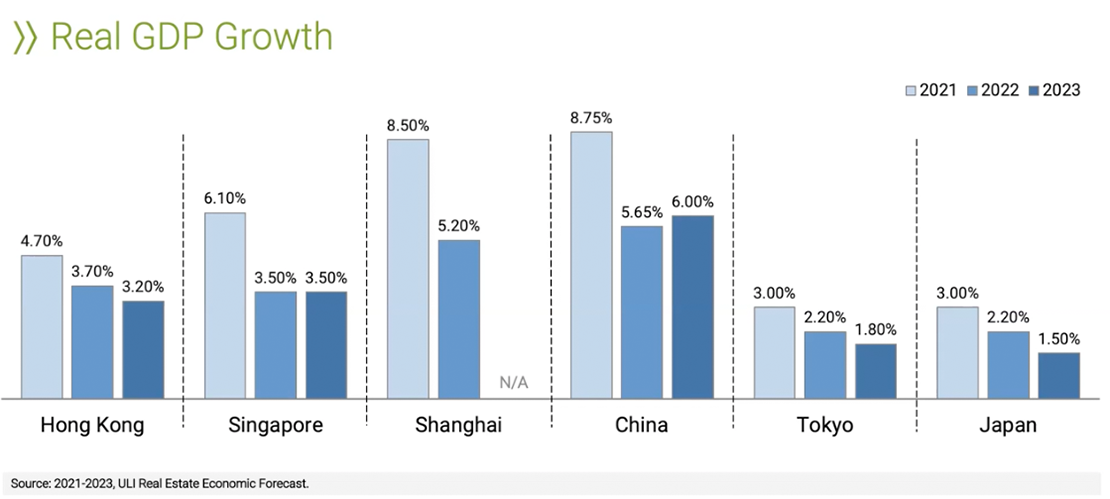

China is forecast to lead the pack with 8.75 percent growth in its real GDP in 2021, followed by Singapore (6.1 percent), Hong Kong (4.7 percent), and Japan (3.0 percent). Economies in the region are expected to grow at a slightly slower pace in 2022 and 2023; however, signs of continuing recovery remain as unemployment rates are expected to continue trending downward across the four key markets surveyed—Hong Kong, Shanghai, Singapore, and Tokyo.

Against this upbeat backdrop, real estate in the four cities is likely to experience a rebound as well, with bright spots in the office and logistics spaces. Although office vacancy rates are expected to expand at a slightly slower rate for the next three years, according to an MSCI office index, the office sectors in Singapore and Tokyo are estimated to return 3.59 percent and 3.1 percent, respectively, before accelerating to 8.63 percent and 4.3 percent in 2023. A rapid shift toward e-commerce also continues to support demand for logistics assets, with rental rates estimated to rise 2.75 percent in Hong Kong in 2022, the highest of the four key markets surveyed. The outlook for the retail sector remains downbeat this year, with rental rates projected to decline in Singapore and Shanghai, as well as Hong Kong.

“The latest ULI Real Estate Economic Forecast paints a bright outlook for the key economies and real estate markets in Asia Pacific, signaling the region’s resilience to the challenges posed by the pandemic,” says David Faulkner, president of ULI Asia Pacific. “Even so, pockets of uncertainties remain as recovery would depend on the pace of the reopening of the global economy, as well as the reemergence of the virus, which may lead to another round of lockdowns.”

The forecast’s findings are based on a survey of economists and analysts at eight leading real estate and investment organizations: Aberdeen Standard Investments, AEW, Cushman and Wakefield, Heitman, JLL, Morgan Stanley, Nuveen Real Estate, and Phoenix Property Investors. It is also based on historic data provided by JLL, MSCI, and Oxford Economics. The report takes a deep dive into the three-year forecast for key economic and real estate data points for the Asia Pacific’s four major markets.

Take a deep dive into the regional Real Estate Economic Forecasts by downloading the reports or watching the webinars on Knowledge Finder.

Explore